|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

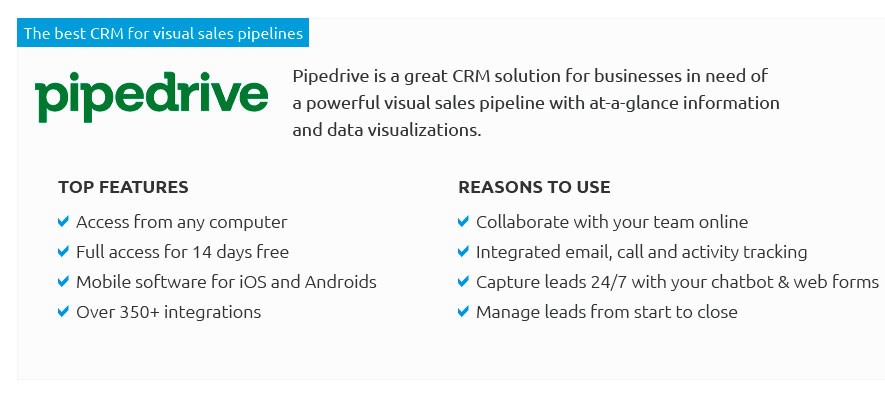

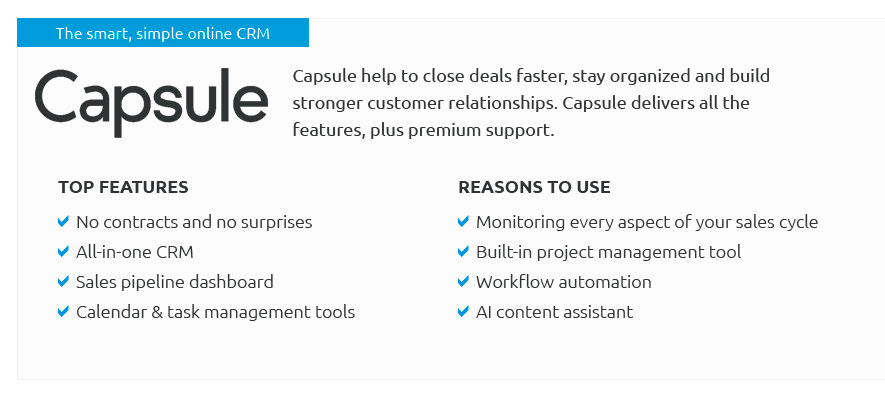

Understanding Broker CRM: An Essential Tool in Modern BrokerageThe world of brokerage is one of rapid transactions, fluctuating markets, and the ever-present need to maintain impeccable client relationships. As we move further into the digital age, the role of Broker CRM (Customer Relationship Management) systems has become increasingly significant. These systems are not just databases but are sophisticated platforms designed to streamline operations, enhance client interactions, and ultimately, boost profitability. In this article, we will delve into why Broker CRM systems are indispensable, the key features to look for, and some subtle opinions on how they can be optimized to suit the unique needs of brokers. At its core, a Broker CRM system is about efficiency and relationship building. In an industry where time literally equates to money, having a system that consolidates client information, tracks interactions, and forecasts client needs is invaluable. Consider this: a broker without a CRM is like a captain navigating the high seas without a map. The CRM acts as a compass, guiding brokers through the complex waters of client management.

While the advantages of Broker CRM systems are clear, it’s essential to choose a system that aligns with your specific business needs. Customization is key; a one-size-fits-all approach rarely works in the dynamic world of brokerage. The ability to customize dashboards, reports, and workflows can significantly enhance a CRM's effectiveness. Furthermore, integration with existing tools and platforms is another critical consideration. A CRM system that seamlessly integrates with your trading platforms, communication tools, and other software will ensure a smooth operation with minimal disruption. In our subtle opinion, while technology is a powerful ally, the human element should never be overlooked. A CRM system is a tool to enhance, not replace, personal interactions. Brokers should leverage technology to foster genuine relationships rather than rely solely on data-driven interactions. The most successful brokers are those who find the perfect balance between technology and personal touch, using CRM systems as a springboard to deliver exceptional client experiences. In conclusion, a well-implemented Broker CRM system is more than just a technological upgrade; it is a strategic investment in the future of a brokerage firm. By providing a framework for efficient client management, data-driven insights, and regulatory compliance, these systems empower brokers to not only meet but exceed client expectations. As you navigate the options available, remember that the best CRM is one that grows and evolves with your business, continuously adapting to the ever-changing landscape of the brokerage industry. Investing time in selecting the right CRM will undoubtedly pay dividends in the form of strengthened client relationships and increased profitability. https://brokercrm.tech/

Broker CRM is an application that assists brokers with managing all their client data, including their providers, products, leads, and claims. https://www.topbrokercrm.com/

TopBroker CRM is a web-based agency management system that provides the tools and resources to help with business growth, agency management, agent and ... https://www.totalbrokerage.com/

Robust Management Software. Offer agents a fully integrated, mobile-friendly platform combining CRM, transactions, marketing, and e-signature, streamlining ...

|